The Road to Growth: With Help from 411 & Thinking Capital

- Laura Condie

- August 3, 2016

- 0 Comments

Interested in the Entrepreneurs Club? See how we can help your business with a business website, Google AdWords plan, or advertising on 411.ca.

Some small businesses are content with their size and have no plans to expand – and that’s perfectly okay. However, many entrepreneurs aren’t satisfied with their ‘small business’ status and yearn to make the leap to expand. They have dreams of purchasing new equipment, opening a new location, or investing in branding and marketing, but may find themselves limited by their finances.

The goal of The Entrepreneurs Club is to give entrepreneurs special rates on all the necessary resources needed to help their business grow, so, it’s only fitting that we help our members gain access to capital to fund their goals.

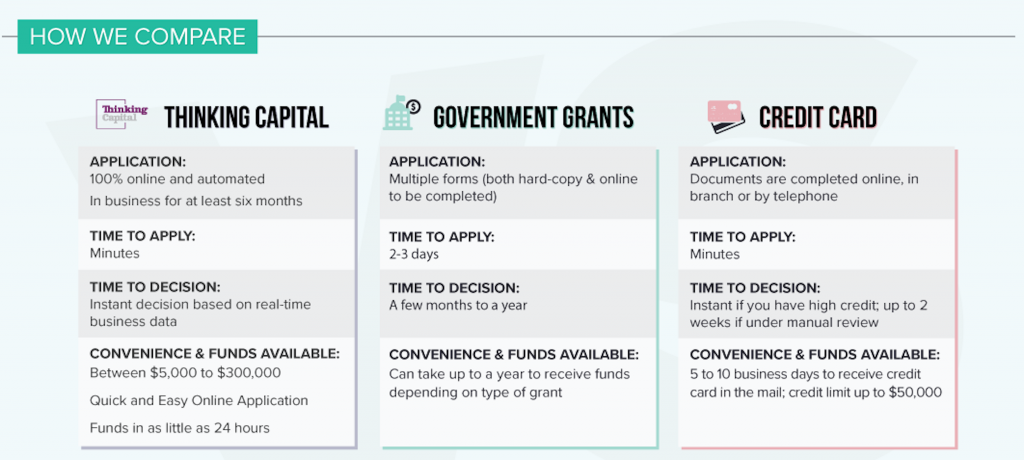

We’re proud to announce Thinking Capital as our newest Entrepreneurs Club partner. Thinking Capital offers business financing from $5,000 to $300,000 in as little as 24 hours to help you meet your business goals. As Canada’s top online loan provider, they’ve been trusted by over 10,000 small businesses since 2006.

Canada’s fintech industry has already begun seeing major momentum. As inc.com puts it, “fintech is being revolutionized by entrepreneurs for entrepreneurs.” Fintech companies challenge traditional ways of accessing capital, such as from financial institutions, by providing business owners with online lending platforms.

“Fintech has been a huge driving force for the small business community in Canada. We see bigger and better things on the rise for small businesses as they now have more options to get the funding they need to grow in a short period of time.”

As a leader in Canada’s fintech landscape, Thinking Capital makes financing a viable option for small businesses that may not have access to capital otherwise. The company leverages innovation and technology to help Canadians grow their businesses all year long. Their smart technology and software algorithms accelerate approval times, which means business owners can acquire capital almost instantaneously to react quickly in today’s fast paced business environment. The effortless application process means you can get access to capital in as little as 24 hours (the time it can take to APPLY for some loans).

At the end of the day, Thinking Capital and 411 are an ideal match because we have similar goals – to help Canadian entrepreneurs succeed and grow their businesses.

Visit their site to learn more about how Thinking Capital’s financing solutions can help turn your business dreams to reality and head over to Thinking Capital’s blog for tips and information on all things small business.

Interested in the Entrepreneurs Club? See how we can help your business with a business website, Google AdWords plan, or advertising on 411.ca.

Laura has a B.A. in Honours Communications Studies from McMaster University and is currently enrolled in Humber’s Public Relations Postgraduate program. She is passionate about writing and local business, so this blog is the perfect combination of the two.

About 411dotca Blog

Ideas, recommendations and tips for connecting with local businesses in Canadian neighbourhoods.

#LocalsLoveUs

Subscribe to our blog

411dotca Facebook

DISCLAIMER